irs child tax credit tool

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. WASHINGTON The Internal Revenue Service today launched two.

Child Tax Credits Irs Details How To Get Missed Payments

The enhanced credit gives families up to 3600 for each child under 6 and 3000 for each one under age 18.

. IR-2021-150 July 12 2021. The payments are part of a 2021 expansion to the existing Child. Under a new law signed by President Biden on March 11 2021 individuals and families with children can get up to 300 per month per child under age 6.

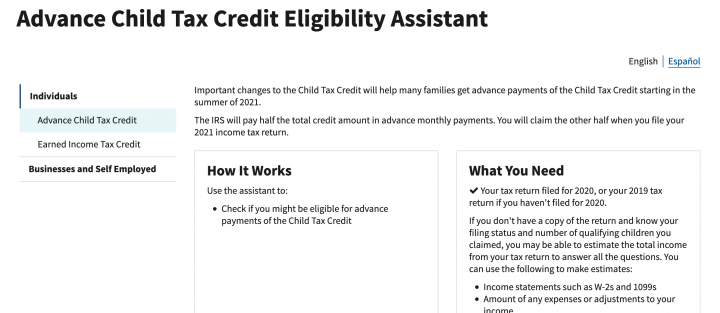

Heres what families should know about the online IRS tools before the last remaining check comes this year. WASHINGTON The Internal Revenue Service has launched a new Spanish-language version of its online tool Child Tax Credit Eligibility. The agency also unveiled a non-filer tool last week which allows families who dont normally file taxes to enroll.

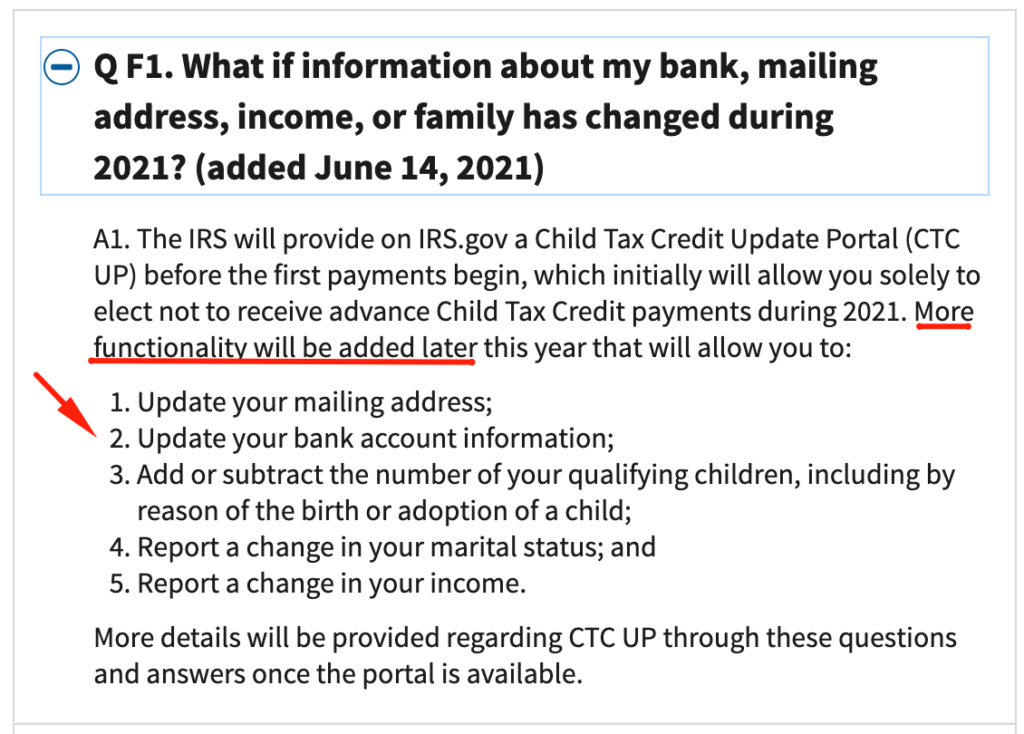

TAS Tax Tip. Update Portal helps families monitor and manage Child Tax Credit payments. IR-2021-130 June 22 2021.

Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. Our analysis ofthe Child Tax Credit. The IRS has launched an online tool to help low-income families register for monthly child tax credit payments.

Claim Your Child Tax Credit. The new collaboration with Code. WASHINGTON The Treasury Department and the Internal Revenue Service today urged families to take advantage of a special online tool that can help them determine whether.

So yes its up to 2000 per eligible child in 2022. The tool asks you a couple of questions. Use our simplified tax filing tool to claim your Child Tax Credit Earned Income Tax Credit and any missing amount of your third stimulus payment.

IRS Resources and Guidance Includes e-posters in other languages user. Its-a-write-off 3 min. To reconcile advance payments on.

No changes to that are proposed yet for 2023. But it doesnt work on mobile devices which advocacy. This new tool is accessible just on IRSgov.

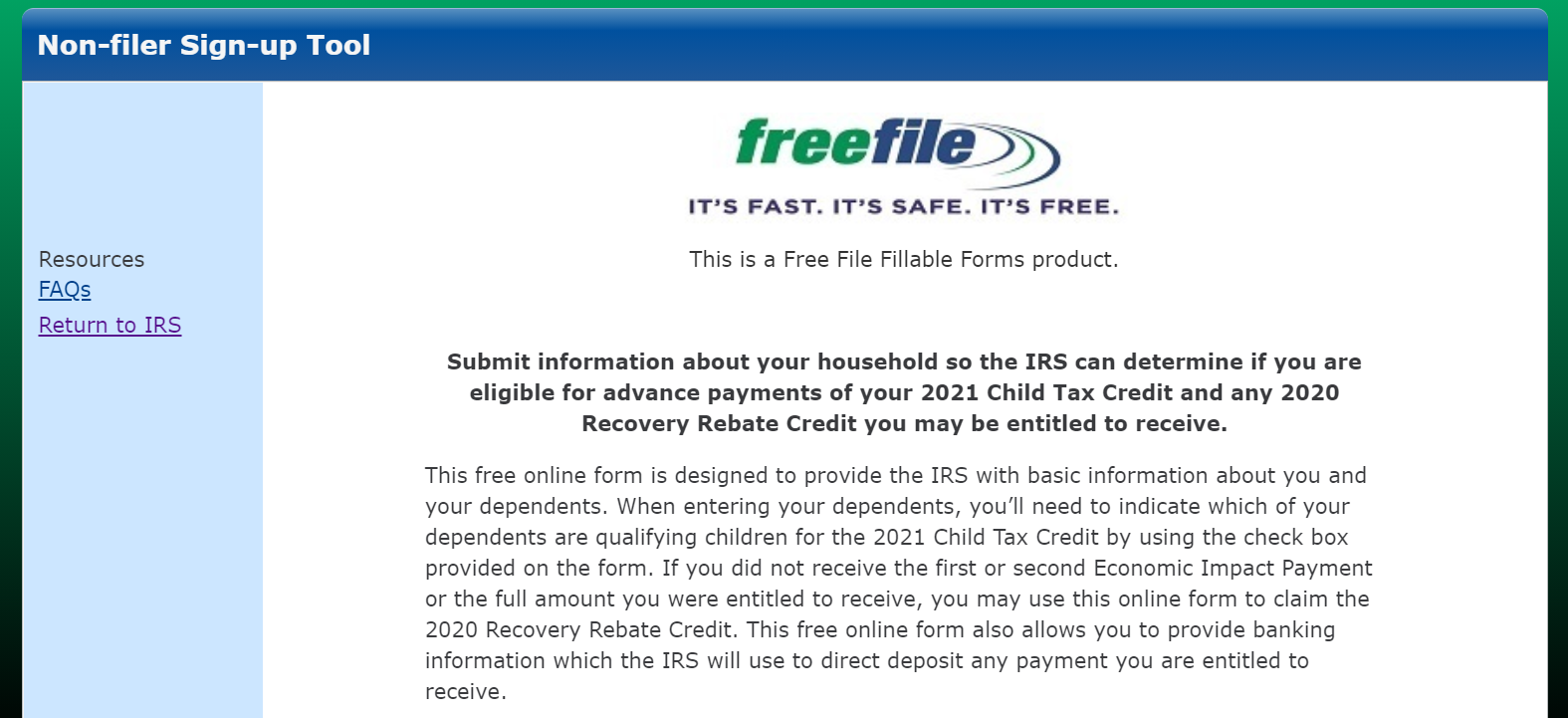

IRS Child Tax Credit Non-filer Sign-up Tool Helps you report qualifying children born before 2021. An online tool for taxpayers who dont normally file tax returns has been updated to provide the IRS with information to claim the 2021 Child Tax Credit. If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you can use the Code for America.

Advance Child Tax Credit. It is a tax credit that you claim. This is up from the existing credit of up to 2000 per child under.

Families who guarantee the Child Tax Credit for 2021 will get up to 3000 per qualifying child who is somewhere in the range of 6 and 17 years of. The IRS urges families to use a special online tool available only on IRSgov to help them determine whether they qualify for the child tax credit and the special monthly. Optional Tool Available to Track Your Advance Child Tax Credit Payments The IRS began issuing advance payments of the Child Tax Credit CTC in mid-July.

You can use your username and password for the Child Tax. There is a child tax credit each year. The Child Tax Credit Eligibility Assistant tool helps families determine if they qualify for the new monthly child tax credit payments.

Notify the IRS of an address or name change to make sure the IRS can process your tax return send your refund or contact you if needed.

Irs Tool For Advance Child Tax Credit Relational Advisors

Irs Unveils Online Tool To Help With Monthly Child Tax Credit Payments Morgan Associates

New 3 600 Child Tax Credit Portal How To Unenroll From Child Tax Credit 2021 Youtube

How To Fill Out The Irs Non Filer Form Get It Back

Tools To Unenroll Add Children Check Eligibility Child Tax Credit

Irs Launches New Online Tool To Help Families Register For Monthly Child Tax Credit Wsav Tv

Irs Releases Online Tools Ahead Of Child Tax Credit Payments Eder Casella Co Certified Public Accountants

Irs Tool To Register For The Monthly Child Tax Credit Payments Now Open

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Irs Tool Helps Low Income Families Register For Monthly Child Tax Credit Payments Tax Pro Center Intuit

Irsnews On Twitter An Irs Tool Now Enables Families To Quickly And Easily Unenroll From Receiving Monthly Payments Of The Childtaxcredit If They So Choose Https T Co Qt9tauwjvv Https T Co Zmqoijn0gv Twitter

New Child Tax Credit Tool Released By Irs To Help People Get Their Monthly Payments Nj Com

Two New Child Tax Credit Tools Launched By Irs More Features Are Coming The Agency Says Nj Com

Child Tax Credit Portal Why Is The Irs Closing Its Ctc Tool Marca

Irs Unveils Tool To Opt Out Of Monthly Child Tax Credit Payments

Expanded Child Tax Credit Senator Bernie Sanders

Irs On Father S Day The Irs Wants Eligible Families Who Did Not File Taxes For 2019 Or 2020 And Didn T Use The Irs Non Filers Tool For Economic Impact Payments To Know

Irsnews On Twitter The New Irs Child Tax Credit Eligibility Assistant Tool Is Useful To Families Who Don T Normally File A Federal Tax Return And Have Not Yet Filed Either A 2019